Estimating an individual's financial standing, often expressed as their total assets minus liabilities, is a common practice. This figure, when available, provides a snapshot of an individual's economic position. Publicly available information about such figures is often limited and potentially inaccurate, especially without a verifiable source.

Determining an individual's financial status is inherently complex. While the concept is straightforward, the specific details are rarely readily accessible to the general public. There is often limited public data available to support any given estimation, and the absence of such data should not be misinterpreted as an indicator of economic standing. Without transparent financial disclosures, determining net worth becomes speculative. Furthermore, the relevance or significance of such information varies depending on the context.

This article will proceed to discuss broader topics related to wealth, financial information accessibility, and the challenges in establishing accurate financial valuations.

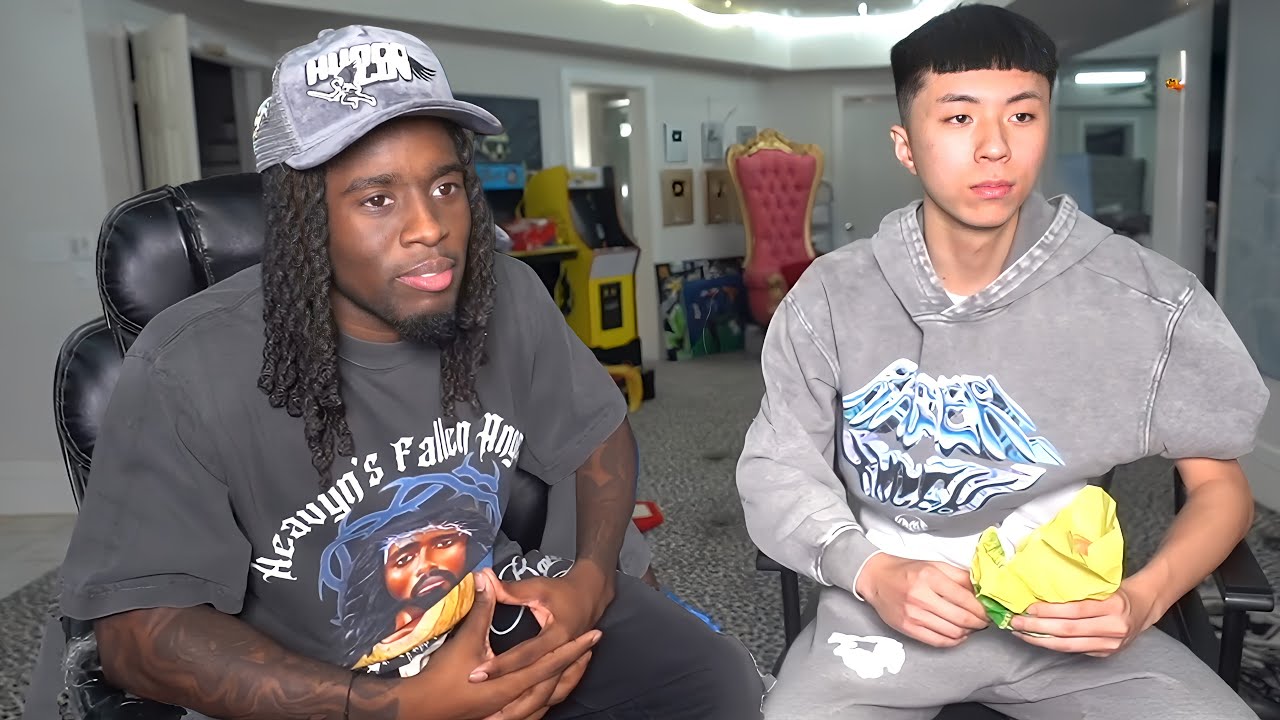

rayasianboy net worth

Assessing an individual's financial standing requires careful consideration of various factors. Publicly available information about such figures is often limited and potentially inaccurate.

- Financial data

- Asset valuation

- Liability assessment

- Public disclosure

- Verification methods

- Transparency

- Economic context

- Source reliability

The presented aspectsfinancial data, asset valuation, and liability assessmentform the fundamental building blocks for determining net worth. Public disclosure of this data is essential for transparency and trust. Verification methods, such as audited financial statements, are crucial for establishing accurate valuations. The economic context, encompassing market fluctuations and economic trends, profoundly influences asset values. Understanding these factors is paramount for any meaningful analysis of financial standing. Without verifiable sources and a proper understanding of these elements, claims about net worth remain speculative and lack substantial value.

1. Financial data

Financial data is fundamental to understanding any individual's financial position, including the concept of "rayasianboy net worth." Net worth is calculated by subtracting total liabilities from total assets. These assets and liabilities are derived from financial records and transactions. Without access to these records, any estimation of net worth is inherently unreliable.

The reliability of financial data significantly impacts the accuracy of a net worth calculation. Accurate financial data encompasses meticulous tracking of income, expenses, investments, and debts. Incomplete or inaccurate records can lead to misrepresentations of the true financial position, whether intentional or accidental. For example, if an individual undervalues or misrepresents the value of assets, their net worth will be inaccurately reported. Conversely, if debts or liabilities are understated or omitted, the net worth is inflated. The practical implication of this is that financial data is essential for providing a transparent and meaningful view of an individual's economic standing.

In summary, a lack of comprehensive and reliable financial data hinders the accurate determination of net worth. The availability and accuracy of such data are crucial for establishing a true picture of an individual's financial health. Without accurate financial data, any estimation of net worth is inherently flawed and unreliable. The quality of financial data directly influences the validity and usefulness of any associated conclusions.

2. Asset Valuation

Accurate asset valuation is fundamental to determining net worth. The value assigned to assets directly impacts the calculated net worth figure. Fluctuations in asset values can significantly alter the overall financial picture. This exploration delves into key aspects of asset valuation relevant to financial assessment.

- Methods of Valuation

Various methods exist for estimating asset values, each with its own assumptions and limitations. Market-based approaches, such as comparing similar assets in the marketplace, provide one perspective. Intrinsic valuation, which analyzes underlying economic factors, offers another. The choice of method profoundly influences the estimated worth, especially when dealing with unique or illiquid assets.

- Impact of Market Conditions

External market forces heavily influence asset valuations. Economic downturns or booms can drastically affect values, whether of real estate, stocks, or other assets. Understanding the current market context is crucial for a reliable valuation. A property valued at a peak market might be significantly less desirable in a downturn. The dynamic nature of markets underlines the need for ongoing assessment to ensure accuracy.

- Appraisal and Expert Opinion

For complex assets like real estate or specialized equipment, professional appraisals are essential. Expert opinions provide detailed assessments factoring in various market and condition-specific elements. The insights of qualified appraisers offer more nuanced and accurate valuations compared to casual estimations. Appraisals provide a stronger foundation for accurate calculations of net worth.

- Time Sensitivity

Asset valuations are not static; they change over time. Market fluctuations, economic shifts, and the specific condition of assets necessitate periodic reassessments. A valuation made at one point in time might not reflect the current market conditions or the asset's true worth. Ignoring this time sensitivity can lead to inaccurate financial estimations.

In conclusion, accurate asset valuation is critical for a precise determination of net worth. Understanding the methods used, the market's impact, the role of expert opinions, and the importance of time sensitivity provides a more informed perspective on the evaluation process. Inadequate attention to these factors can result in misrepresentations of overall financial health. By employing robust and reliable valuation methods, individuals can develop a more accurate understanding of their financial standing.

3. Liability Assessment

Liability assessment is an integral component of determining net worth. Accurate identification and valuation of liabilities are crucial for a precise calculation. Liabilities, representing financial obligations, directly impact the net worth figure. A comprehensive assessment considers various types of debt, including loans, mortgages, outstanding bills, and other financial commitments. Overlooking or underestimating liabilities results in an inflated net worth, presenting a misleading picture of financial health.

The impact of liability assessment on net worth is significant. Consider a scenario where an individual possesses substantial assets, such as a home and multiple investments. However, if they also hold high levels of debt, such as large outstanding loans or significant credit card balances, the true net worth is substantially reduced. Accurate liability assessment acknowledges these obligations, providing a realistic evaluation of the individual's financial position. In contrast, failing to account for these liabilities creates a distorted view of wealth. Furthermore, accurate liability assessment enables informed financial planning and decision-making.

The practical significance of understanding this connection is profound. Individuals can assess their financial health more accurately, identify potential areas for improvement, and develop strategies for debt reduction or management. This understanding allows for a proactive approach to managing financial obligations. Precise liability assessment facilitates informed financial decisions, enabling individuals to make choices aligned with their actual financial capacity. The accurate calculation of net worth, including liabilities, empowers sounder financial strategies and promotes better financial planning. Without a thorough liability assessment, individuals may be misled by a potentially misleading net worth figure and potentially make poor financial choices. Ultimately, this understanding contributes to sound financial stewardship and facilitates informed decision-making.

4. Public Disclosure

Public disclosure of financial information, while not always directly applicable to an individual like "rayasianboy," is a critical aspect of financial transparency and accountability. Its relevance to assessing net worth lies in the potential for verifiable data. A lack of accessible, verifiable information can render estimations of net worth highly speculative.

- Accessibility and Verification

The availability of public financial records or statements allows for independent verification of claims about net worth. For publicly traded companies, financial statements are routinely required. This allows investors and the public to assess financial performance, balance sheets, and shareholder equityall components in calculating net worth. Without this accessibility and verification, determining true net worth becomes considerably more challenging.

- Impact on Perception

Public disclosure can significantly influence public perception of an individual's or entity's financial standing. Transparency in financial dealings fosters trust and credibility. Conversely, a lack of disclosure might raise suspicion or concerns about underlying financial health. This can influence investment decisions, business partnerships, or public confidence, which indirectly relates to understanding net worth. Transparency, or lack thereof, carries implications for an individual's or entity's reputation and perceived net worth.

- Legal and Regulatory Implications

Certain industries or professions have mandatory disclosure requirements. For example, regulatory bodies require public reporting of financial information for publicly traded corporations. These requirements impact how financial health is presented. The absence of such disclosure often triggers investigations or legal scrutiny. The potential for legal issues arising from non-compliance underscores the importance of proper disclosure practices. These standards and consequences are relevant to understanding the context surrounding estimations of net worth.

- Limitations and Practical Considerations

While public disclosure enhances transparency, limitations exist. Not all individuals or entities are subject to mandatory disclosure requirements. Furthermore, the information itself may not directly correlate to net worthit might instead reflect a snapshot of a company's or individual's financial position at a particular time. Factors such as privacy concerns and the nature of the business further complicate the picture. The degree of public disclosure influences the scope and reliability of any estimate of net worth.

In conclusion, public disclosure plays a significant role in the context of net worth. While not a definitive measure, publicly available information, when available, strengthens the reliability and validity of estimations. The absence of such disclosure renders any assessment significantly more speculative. The complexities and limitations of public disclosure must be considered alongside the potential benefits of transparency when analyzing the concept of net worth, particularly when dealing with limited data.

5. Verification Methods

Determining an individual's net worth, in this case, requires robust verification methods. Without verifiable evidence, estimations remain speculative and lack substantial value. Verification methods are crucial because they provide a degree of confidence in the accuracy of reported figures. These methods confirm the validity of claims about assets, liabilities, and overall financial standing. The absence of such verification renders estimations of net worth inherently unreliable.

The methods employed for verification vary significantly depending on the nature of the assets and liabilities involved. For publicly traded companies, audited financial statements are commonly used to validate reported figures. These statements undergo rigorous scrutiny by independent auditors, ensuring accuracy and transparency. In cases involving private individuals or businesses, verification might rely on bank statements, tax returns, and other financial records. However, the absence of readily available and verifiable information can make determining an accurate net worth exceptionally difficult. For instance, if a claim of substantial wealth is made without supporting documentation, skepticism is warranted. Verification methods are vital to mitigate such uncertainties.

The practical significance of verification methods lies in their ability to foster trust and confidence in financial estimations. Well-documented and verified figures provide a more reliable foundation for investment decisions, business partnerships, and other financial interactions. Verification methods act as a safeguard against misrepresentation or inflated claims, promoting transparency and accountability. Without these methods, estimations of "rayasianboy net worth" or any other individual's financial standing become subjective and prone to manipulation. The importance of verification methods underscores the significance of credible evidence when evaluating an individual's or entity's financial position. Ultimately, well-established verification procedures are a cornerstone of accurate estimations and responsible financial engagement.

6. Transparency

Transparency in financial matters, including the concept of an individual's net worth, is crucial for establishing credibility and reliability. A lack of transparency can lead to skepticism and questions about the accuracy and validity of reported figures. Conversely, demonstrable transparency fosters trust, encouraging acceptance of the presented financial data. The absence of verifiable documentation can significantly diminish the credibility of claims about financial standing, leaving estimations of net worth open to doubt and interpretation.

Consider a scenario where an individual asserts substantial wealth but offers limited or no verifiable documentation. This lack of transparency casts doubt on the veracity of the claim, making it difficult to assess the accuracy of the asserted net worth. Conversely, individuals or organizations who proactively and transparently disclose their financial information, such as through audited financial statements, tend to build stronger reputations and earn greater credibility. This transparent approach builds trust, increasing confidence in the reported figures and supporting the claims related to net worth. Transparency acts as a safeguard against misrepresentation, enabling a more accurate and objective evaluation of financial standing. Real-world examples abound where a lack of transparency has damaged reputations or hindered the acceptance of financial claims.

The practical significance of transparency in the context of net worth is substantial. Reliable and verifiable financial data, when publicly available, fosters a greater understanding of financial health. Transparency empowers informed decision-making, as stakeholders can analyze and evaluate financial disclosures independently. Further, this transparency contributes to informed assessments for investment decisions, partnerships, and public perception. While complete transparency may not always be attainable, the practice of increasing transparency in financial reporting fosters trust, promotes sound financial practices, and enables a clearer evaluation of an individual's or organization's overall financial standing. The core message is that transparency, when present, significantly strengthens the validity and credibility of claims regarding net worth.

7. Economic Context

Economic conditions significantly influence an individual's financial standing, including the concept of "rayasianboy net worth." Market fluctuations, economic growth, and broader economic trends all play a role in shaping an individual's asset values, income potential, and overall financial health. Understanding these factors is essential for a complete and nuanced perspective on financial standing.

- Impact of Economic Growth

Periods of economic expansion often correlate with increased asset values. Rising stock markets, increased demand for goods and services, and higher employment rates all contribute to enhanced personal wealth. During these times, individuals may see gains in investments, property values, and earnings, positively impacting net worth. Conversely, economic downturns can lead to asset devaluation and reduced income, potentially decreasing net worth.

- Influence of Market Fluctuations

Volatility in financial markets directly affects asset valuations. Sudden shifts in market sentiment, unforeseen events, or global economic instability can cause significant swings in the value of investments, stocks, and real estate. These fluctuations create inherent uncertainty and impact the overall calculation of net worth.

- Role of Inflation and Interest Rates

Inflation erodes the purchasing power of assets and income over time. Higher interest rates can increase borrowing costs and impact investment strategies, potentially affecting an individual's net worth. Understanding these economic variables is critical for accurately assessing the true value of assets and liabilities.

- Employment Trends and Income Potential

The job market and prevailing salary trends directly affect an individual's income. Changes in employment rates, industry-specific dynamics, and overall economic conditions can influence an individual's earning capacity. These factors, in turn, significantly impact an individual's ability to accumulate and maintain wealth, thereby affecting their net worth.

In summary, the economic context is an essential consideration when evaluating an individual's financial standing. The interplay of growth cycles, market fluctuations, inflation, interest rates, and employment trends all contribute to the dynamic nature of net worth. Failure to consider these factors can lead to an incomplete or inaccurate assessment of an individual's financial position.

8. Source Reliability

The accuracy and reliability of sources significantly impact any estimation of an individual's financial standing, including the concept of "rayasianboy net worth." Without reliable sources, conclusions about net worth become highly speculative and potentially misleading. The validity of reported figures hinges critically on the origin and trustworthiness of the information. If the source is unreliable, the estimation of net worth is unreliable.

Consider a scenario where a claim of substantial wealth is made, but the source lacks transparency or verification. For example, unverified social media posts or unsubstantiated online articles, without independent verification, cannot provide a basis for a reliable assessment of net worth. This lack of corroboration makes the figure untrustworthy and of limited value for understanding the individual's actual financial status. In contrast, data sourced from audited financial statements, official tax records, or reputable financial news outlets provide a stronger foundation for an accurate determination. Such sources, when available, allow for a more dependable assessment. Real-life examples abound where the reliability of the source material directly affects the validity of reported net worth.

The practical significance of understanding source reliability is profound. Accurate estimations of net worth facilitate informed decisions related to investments, partnerships, and business dealings. Unreliable sources can lead to incorrect judgments, potentially impacting critical financial choices. Reliable sources, on the other hand, enable a more objective and informed approach to financial analysis, contributing to better estimations of financial standing. Ultimately, prioritizing source reliability safeguards against misinterpretations and allows for more accurate assessments, leading to a deeper and more precise understanding of an individual's economic position.

Frequently Asked Questions about Net Worth

This section addresses common inquiries related to understanding net worth, specifically focusing on the complexities of assessing an individual's financial standing. Accurate information about an individual's net worth is crucial for informed decisions, but challenges often arise in its precise determination.

Question 1: What is net worth?

Net worth represents an individual's total assets minus their total liabilities. Assets include possessions of monetary value, such as property, investments, and cash. Liabilities encompass financial obligations, like loans and debts. A positive net worth indicates an excess of assets over liabilities, while a negative net worth signifies that liabilities exceed assets. Determining net worth requires careful accounting of all assets and liabilities.

Question 2: How is net worth calculated?

Calculating net worth involves a meticulous process. First, accurately assessing the monetary value of all assets is essential. This includes valuing property, investments, and other possessions. Simultaneously, all liabilities must be identified and assessed. This includes accurate calculation of outstanding loans, debts, and other financial obligations. The net worth is then computed by subtracting total liabilities from total assets. The accuracy of the calculation hinges on the precision of asset and liability valuations.

Question 3: Why is it challenging to determine someone's net worth publicly?

Publicly determining an individual's net worth is often complex due to privacy concerns and limited access to financial information. Personal financial records are typically confidential. Verifiable records, such as tax returns or financial statements, may not always be readily available to the public, especially for individuals who choose not to disclose such details. Further, public estimations can be speculative, lacking the verifiable evidence necessary for precise calculation.

Question 4: What factors influence net worth?

Numerous factors impact net worth. Economic conditions, including market fluctuations and economic cycles, significantly influence asset values. Investment choices, income levels, and debt management strategies directly affect the individual's financial position. Changes in personal circumstances, such as job losses or major purchases, can also alter net worth.

Question 5: Is it possible to estimate net worth accurately without full disclosure?

Precise estimation of net worth without full disclosure is often problematic. Without access to comprehensive financial information, any calculation is inherently speculative. Publicly available data, while sometimes helpful, may not represent the entirety of an individual's assets and liabilities. Estimation without complete data introduces significant uncertainty into any net worth calculation.

Question 6: What is the significance of net worth?

Understanding net worth is valuable for personal financial planning. A clear picture of financial standing allows individuals to assess their financial health, make informed decisions about investments and debt management, and develop long-term financial strategies. Accurate estimations enable more effective planning, enabling individuals to proactively address their financial goals.

In conclusion, understanding net worth involves careful assessment of assets, liabilities, and the various economic factors that influence it. The accuracy and reliability of sources used for estimation are critical. Without access to comprehensive financial information, accurate determinations of net worth are challenging. Therefore, any reported estimation of net worth should be approached with careful consideration.

The following sections will delve deeper into specific aspects of wealth, financial planning, and asset valuation.

Tips for Understanding and Managing Financial Standing

This section offers practical guidance for evaluating and effectively managing personal finances. Accurate financial assessments and sound strategies are crucial for long-term financial well-being.

Tip 1: Establish Comprehensive Financial Records. Maintaining detailed records of income, expenses, investments, and debts is fundamental. This includes tracking all sources of income, categorizing expenditures, and meticulously documenting investment activities and loan payments. Regular review of these records provides a clear picture of financial inflows and outflows, aiding in identifying areas for improvement.

Tip 2: Regularly Assess Asset Values. Accurate valuation of assets is essential for a precise net worth calculation. This involves periodically reviewing investment portfolios, property values, and other assets. Using professional appraisals for complex assets like real estate or specialized equipment provides more precise valuations compared to estimations. Staying informed about market conditions and trends helps anticipate potential changes in asset values.

Tip 3: Thoroughly Assess Liabilities. Recognizing and accurately assessing all liabilities is critical. This includes outstanding loans, credit card balances, mortgages, and other financial commitments. Comprehensive understanding of liabilities allows for effective debt management strategies. Tracking and categorizing liabilities enables proactive steps toward reducing or managing financial obligations.

Tip 4: Diversify Investments. Diversification of investment strategies reduces risk by spreading investments across various asset classes, such as stocks, bonds, real estate, and other securities. This approach can enhance long-term growth potential while mitigating the impact of unforeseen market fluctuations. Consult with financial professionals for personalized investment strategies.

Tip 5: Prioritize Debt Management. Effective debt management is a cornerstone of sound financial planning. This involves creating a structured plan for debt repayment, including high-interest loans. Understanding and optimizing credit utilization improves credit scores and can lead to favorable interest rates.

Tip 6: Seek Professional Advice When Needed. Consulting with financial advisors or qualified professionals offers specialized guidance and support. Seeking expert opinions and strategies can lead to more informed financial decisions and better risk management. Professional advice enhances the accuracy and effectiveness of financial planning.

Following these tips fosters a more comprehensive understanding of financial standing and aids in establishing sustainable financial strategies. By meticulously tracking financial details, managing assets and liabilities effectively, and seeking guidance when needed, individuals can enhance their financial well-being.

The following sections will delve deeper into various aspects of wealth creation, management, and safeguarding strategies.

Conclusion

Assessing an individual's financial standing, often represented by net worth, requires a multifaceted approach. This analysis highlights the crucial role of accurate asset valuation, meticulous liability assessment, and the importance of verifiable sources. Public disclosure, while valuable, is not always available. The economic context, including market fluctuations and economic trends, profoundly influences asset values and overall financial standing. Without comprehensive, reliable data, any estimation of net worth remains speculative and of limited value.

Determining an individual's net worth necessitates a comprehensive evaluation of their financial situation. Accurate valuation of assets, precise identification and assessment of liabilities, and a careful examination of the economic context are fundamental to a reliable estimation. The absence of verifiable sources or transparency significantly undermines the validity of any conclusions. Consequently, accurate estimations of net worth require careful consideration of these factors, emphasizing the significance of reliable data and a thorough understanding of economic forces. Further research and analysis are warranted to deepen our understanding of such complex financial evaluations.

You Might Also Like

Rick Ross House Address: Find Out More!Heartfelt Best Friend Poems That Will Make You Cry (and Smile)

Sleek New Look For Sleep Token!

Cute & Creative Plush Toy Names - Ideas For Your Friend!

Teenage Girl On Daddy's Lap: Hidden Secrets Revealed

Article Recommendations